Renters Insurance in and around Buffalo

Looking for renters insurance in Buffalo?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

No matter what you're considering as you rent a home - number of bathrooms, location, utilities, townhome or condo - getting the right insurance can be necessary in the event of the unanticipated.

Looking for renters insurance in Buffalo?

Renting a home? Insure what you own.

There's No Place Like Home

The unexpected happens. Unfortunately, the personal belongings in your rented apartment, such as a smartphone, a bicycle and a bed, aren't immune to break-in or theft. Your good neighbor, agent Dan Hawrylczak, is passionate about helping you choose the right policy and find the right insurance options to insure your precious valuables.

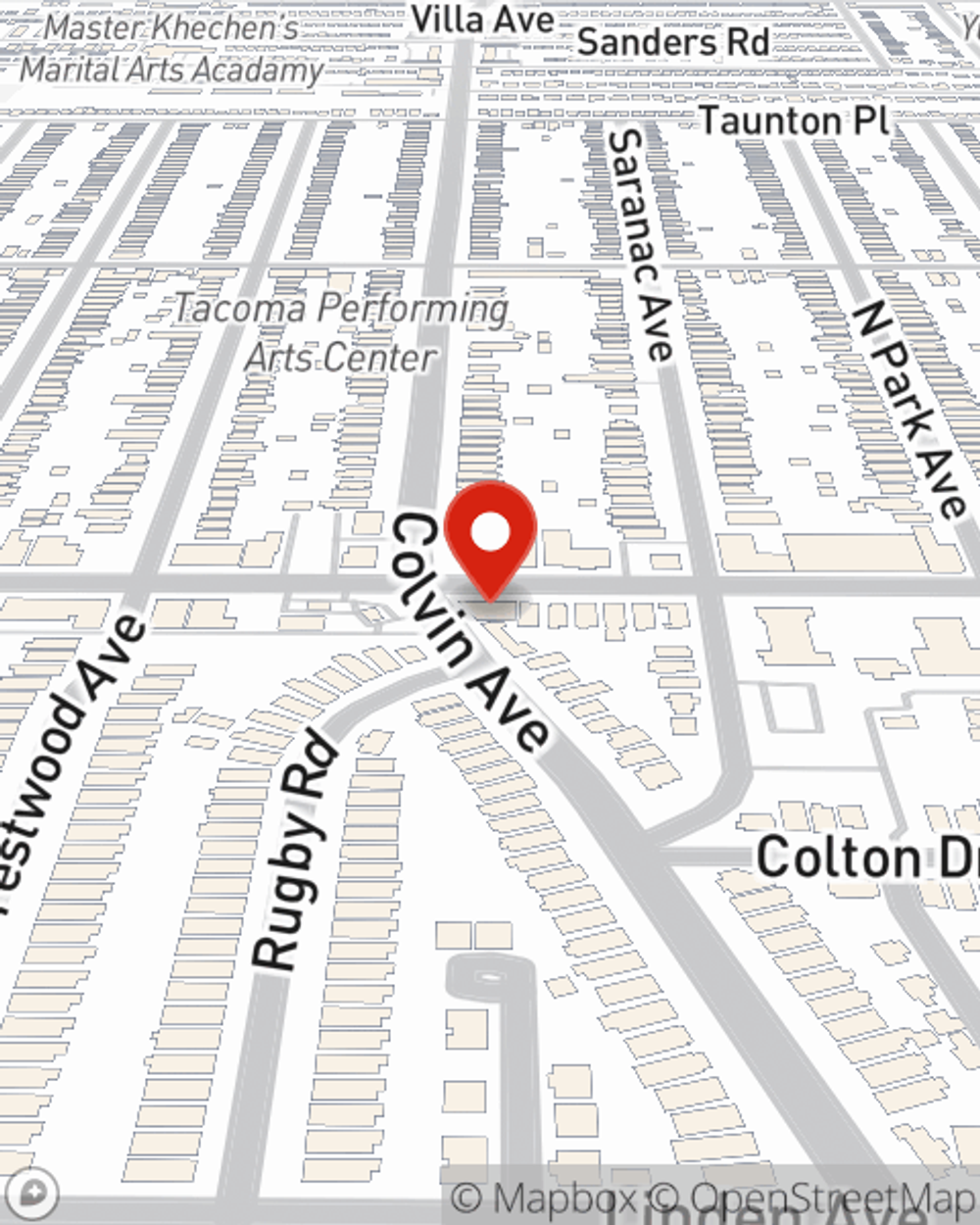

Visit State Farm Agent Dan Hawrylczak today to find out how the leading provider of renters insurance can protect items in your home here in Buffalo, NY.

Have More Questions About Renters Insurance?

Call Dan at (716) 873-3771 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Dan Hawrylczak

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.